Hiring Best Practices | AI-Led Interviews

The Recruitment Metrics HR Leaders Must Track in 2025

Hiring in 2025 feels more like a pressure test than a process. Roles remain open for weeks, candidates disappear midway, and leadership continues to ask the same two questions: Why is this taking so long? And are we hiring the right people?

The truth is, most HR dashboards are not built to answer these questions. They are filled with activity numbers such as résumés reviewed, interviews completed, and applicants per role. None of these reveal whether new hires are performing, staying, or contributing to business results.

And this is where most recruiting strategies fall short. You can reduce time-to-fill by a few days, but if half of those hires leave within the first year, efficiency becomes a false win.

At InterWiz, we have seen this shift first-hand. Recruitment metrics can no longer measure activity alone;; they must measure impact. In this guide, we highlight the recruiting metrics that truly matter in 2025.

Key Takeaways

Quality first. Speed and cost matter, but the real measure is whether new hires perform and stay.

Balance speed with experience. A fast hiring process means little if candidates drop out because it feels disorganized or slow to respond.

Look beyond cost. Cost-per-hire is useful only when tied to outcomes. Cutting spendinging is meaningless if quality suffers.

Diversity drives results. Teams that measure and improve diversity not only meet compliance standards but also perform better and innovate faster.

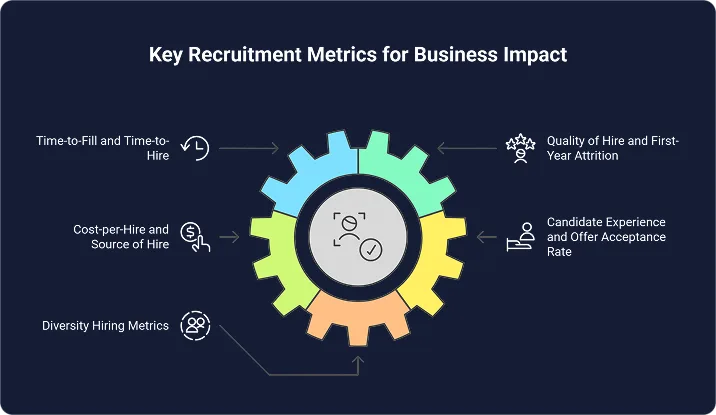

The Recruitment Metrics That Answer the Big Questions

Executives do not want dashboards crowded with activity counts. They want proof that hiring is driving results. That proof comes from a focused set of metrics that go beyond volume and reflect real business impact.

These are the recruitment metrics that answer the questions leaders care about most:

Time-to-Fill and Time-to-Hire → Are we filling roles quickly enough to support business goals?

Quality of Hire and First-Year Attrition → Are we hiring people who succeed and stay?

Cost-per-Hire and Source of Hire → Are we spending wisely on the right channels?

Candidate Experience and Offer Acceptance Rate → Are candidates leaving with a positive view of our brand?

Diversity Hiring Metrics → Are we building a workforce that strengthens innovation and resilience?

These recruitment metrics move the conversation from activity to outcomes, and from HR reports to business results.

In the following sections, we will break down each metric and demonstrate how HR leaders can utilize them to establish credibility at the leadership table.

1. Time-to-Fill vs Time-to-Hire

Imagine this common scenario: finance argues that roles have been open for months, while your recruiting report shows that the average hiring time is just over 30 days. Both are right, but they measure two different recruiting metrics.

Time-to-Fill: Counts the total days from requisition opening to offer acceptance. It shows the business cost of vacancy and highlights delays like slow approvals or unclear role definitions.

Time-to-Hire: Starts when a candidate applies or is sourced and ends when they accept. It reflects recruiter efficiency and the candidate’s experience once in the process. Longer cycles here point to delays in screening, scheduling, or decision-making.

When tracked side by side, the story becomes clear:

Time-to-Fill shows how organizational readiness affects hiring speed.

Time-to-Hire highlights recruiter efficiency once candidates are active.

The gap between them reveals where delays truly sit.

The good news is that separating the two is simple. Report them together, make delays transparent, and use scheduling automation to cut wasted time. InterWiz streamlines interviews and scheduling, giving hiring managers a complete view of where time is gained or lost.

2. Quality of Hire: The Ultimate Success Metric

Every recruiter knows the frustration: you fill a role quickly, the candidate impresses in interviews, and the hiring manager is satisfied. Months later, performance reviews show missed targets or early turnover. On paper, the hiring process looked efficient. In reality, the hire failed.

This is why Quality of Hire matters. It is the one metric that shows whether new hires actually perform, stay, and contribute to the business. Speed and cost metrics are useful, but without Quality of Hire, you’re only measuring the hiring process, not outcomes.

The challenge is that most companies still fail to measure it well. LinkedIn research shows Quality of Hire is ranked as the most valuable recruiting KPI, yet less than 40 percent of organizations track it consistently.

First-year attrition is one of the clearest indicators of Quality of Hire, yet it’s alarmingly high. Gartner reports it averages above 20 percent across industries, and costs businesses an average of $18,000 in lost productivity and rehiring.

When measured properly, Quality of Hire reveals:

Performance: Are hires meeting or exceeding expectations?

Retention: Do they stay beyond the first year?

Ramp-up speed: How quickly do they reach full productivity?

Manager and peer satisfaction: Do they contribute positively to teams?

Improving this metric involves defining success upfront, conducting structured interviews to assess both skills and fit, and consistently tracking performance and retention.

InterWiz helps by standardizing interviews and providing a structured scoring system. It reduces guesswork and turns Quality of Hire into a measurable, repeatable outcome instead of a subjective opinion.

3. Cost-per-Hire

It’s the first question most CFOs ask: “What does each hire cost us?” Without a clear answer, recruiting looks like a black box rather than a strategic function.

Cost-per-Hire is simple in formula but powerful in insight:

(Internal Costs + External Costs) ÷ Total Hires

Internal costs: recruiter salaries, HR tech, referral bonuses, onboarding, interviewer time

External costs: job ads, agency fees, assessments, background checks, relocation, recruiting events

The problem isn’t calculating the number, it’s what the number hides. A blended average often masks where spending actually goes. If even 30% of hires come through agencies, your Cost-per-Hire can double overnight compared to direct sourcing. Cutting spending looks good on paper, but it’s meaningless if quality or retention suffers.

What Cost-per-Hire really reveals:

Budget clarity and credibility with finance leaders

Which sourcing channels bring true ROI versus wasted spend

Over-reliance on costly agencies instead of scalable pipelines

How to act on it:

Break it down by role and sourcing channel; averages hide inefficiencies

Pair it with outcome metrics like Quality of Hire and First-Year Attrition

Automate interviews and scheduling to reduce recruiter hours and vacancy costs

This is where InterWiz helps upfront. By automating interviews, scheduling, and structured scoring, InterWiz cuts hidden recruiter hours and speeds up hiring cycles. The result isn’t just lower Cost-per-Hire, it’s spend that holds up when finance leaders ask the harder question: “Are we paying for hires who actually stay and perform?”

4. Candidate Experience Metrics

A clunky application process or long silences can lose great candidates before an offer is even on the table. Many HR teams still underestimate this, treating candidate experience as a “soft” metric compared to speed or cost. At InterWiz, we see it differently: silence and confusion in the hiring process are the single biggest drivers of drop-offs, even more than salary or job fit.

Candidate experience metrics capture how applicants actually feel about your hiring process. They show whether your hiring journey is building trust or pushing people away, and they are directly tied to offer acceptance, employer brand, and future pipelines.

Quantitative metrics to track include:

Application completion rate → Are candidates dropping mid-application?

Time to first contact → Do they hear back quickly?

Drop-off rate → Where are candidates exiting the funnel?

Offer acceptance rate → Are top choices actually saying yes?

Candidate Net Promoter Score (cNPS) → Would applicants recommend your hiring process?

Qualitative metrics add context, such as:

Post-interview surveys on fairness, professionalism, and communication

Exit reasons from candidates who withdraw before the offer stage

Public reviews on Glassdoor or social media that shape employer perception

Together, these metrics answer critical questions: Are candidates being respected? Are delays creating frustration? And is your hiring process leaving people with a positive impression, even if they aren’t hired?

How to improve candidate experience:

Map the candidate journey and identify friction points

Keep communication timely and consistent throughout the recruiting procedure

Train interviewers to deliver a professional and fair experience

Use structured interviews to ensure every candidate gets equal treatment

5. Diversity Hiring Rate: Building Fair and Future-Ready Teams

Too often, diversity reporting is treated as a compliance exercise. At InterWiz, we see it differently: diversity metrics are leading indicators of innovation, employer brand strength, and long-term workforce resilience. They reveal whether a company is building future-ready teams or repeating the same hiring patterns year after year.

A diversity hiring rate isn’t one single number. It’s a set of signals that show how effectively you attract, select, and retain talent from underrepresented groups. The most valuable measures include:

Applicant diversity ratio: share of underrepresented candidates in the applicant pool

Interview-to-hire ratio: how many diverse candidates progress to final hires

Offer acceptance by demographics: whether diverse candidates accept offers at the same rate as others

Retention of diverse hires: whether employees stay or leave due to inclusion gaps

Representation in leadership: visibility of diverse talent in decision-making roles

These numbers matter because they tie directly to business outcomes. Diverse teams are proven to be more innovative and financially successful, and over 70% of job seekers evaluate employers based on diversity.

Improving outcomes means setting clear goals, widening sourcing pipelines, and using AI structured interviews to reduce bias. It also requires shifting from “culture fit” to “culture add,” so new hires strengthen the organization rather than replicate what’s already there.

6. First-Year Attrition Rate: Spotting Risk Early

Few things sting more than losing a new hire within the first year. After investing time, money, and energy into recruiting and onboarding, watching someone walk away months later feels like starting over, and it’s more common than most leaders realize.

Research shows that at least 38% of new hires leave within their first year, driven by factors like poor onboarding and misaligned job expectations. Each departure costs tens of thousands in lost productivity and rehiring.

Why early attrition happens:

Mismatched expectations between the job description and reality

Selection processes that miss key skills or cultural signals

Weak onboarding that leaves new hires unsupported

Warning signs to watch in the first 90 days:

Disengagement during onboarding or early training

Missed milestones or poor ramp-up speed

Lack of connection with managers or peers

How to reduce first-year attrition:

Align job descriptions with the actual responsibilities

Use structured interviews to test both skills and cultural add

Build onboarding frameworks with clear 30-60-90 day plans

Run pulse surveys in the first quarter to catch issues early

This is an area where InterWiz adds real value by standardizing interviews and scoring across both technical and soft skills. The platform also surfaces insights into candidate strengths and fit, which helps HR teams design onboarding that sets new hires up for long-term success.

7. Hiring Manager Satisfaction: Aligning HR with Business Needs

Recruiting teams often celebrate fast hires or low costs, but if hiring managers are frustrated, none of those wins matter. Manager satisfaction is one of the clearest signals of whether HR is delivering value to the business. At InterWiz, we see it as a credibility metric: if managers lose trust, every other metric gets questioned.

Why it matters:

Shows if recruiters understand the real skills and qualities managers need

Acts as an early warning for weak pipelines or poor candidate quality

Strengthens or erodes HR’s role as a strategic partner

When satisfaction is low, it usually reveals a deeper issue. Sometimes the job description never matched the role. Other times, the pipeline is thin, forcing managers to settle. And often, delays in screening and scheduling leave managers waiting while projects stall. The number on a survey form isn’t the problem; it’s the story behind it.

How to improve:

Involve managers at the start to define role requirements and success criteria

Use standardized scorecards to make evaluations objective instead of opinion-driven

Share market data and recruiting analytics so expectations stay realistic

With InterWiz, managers don’t have to rely on gut feel. They get structured interview data and clear candidate rankings, which makes decisions faster, reduces back-and-forth, and builds more trust between HR and the business.

8. Source of Hire: Knowing What Really Works

Most recruiters are confident they know where their best hires come from. But confidence isn’t the same as proof. Data from LinkedIn shows that referral hires are far more likely to stay, with a 46% retention rate after one year. Career site hires drop to 33%, and job board hires fall further to just 22%.

The lesson is simple: volume doesn’t equal quality. Without tracking these differences, recruiting teams end up defending hunches to leadership instead of showing a clear return on investment.

Why this metric matters:

Prevents wasted spend on high-volume but low-quality sources

Reveals over-reliance on one channel, which increases pipeline risk

Builds credibility with leadership by tying sourcing decisions to outcomes

It’s a scenario most HR leaders have faced: thousands spent on agencies or job ads, while the longest-tenured hires come from referrals or direct career site traffic. Without hard data, the CFO questions recruiting spend, and HR has little to stand on.

How to use it well:

Attribute every hire to the true first source (referral, job board, social, career site, campus, agency)

Track not just volume but retention and performance from each channel

Compare cost-per-hire across sources to make budgeting defensible

9. Offer Acceptance Rate: Testing Your Hiring Competitiveness

Nothing slows hiring like a declined offer. Offer Acceptance Rate (OAR) shows how often this happens and whether your process and package are strong enough to win top talent.

Why it matters:

Signals competitiveness on pay, benefits, and flexibility

Reflects how candidates experienced the hiring process

Directly impacts speed and cost, since every decline adds more vacancy days

Glassdoor data suggests that nearly one in six job offers is rejected, and the rate is higher in technical and senior roles. Salary plays a role, but most declines come from somewhere else: interview processes that drag on too long, communication gaps, or roles that felt oversold during the hiring journey.

How to improve OAR:

Benchmark compensation regularly to stay aligned with the market

Shorten interview timelines and give feedback quickly

Communicate clearly about growth opportunities and culture, not just pay

Ensure candidates feel the hiring process is structured, consistent, and respectful

At InterWiz, we see OAR as more than a number. Candidates who go through a disorganized process are far more likely to say no, even if the offer is competitive. By automating scheduling, reducing interview delays, and delivering structured interview experiences, InterWiz helps recruiters close the gap between a “maybe” and a “yes.”

10. Candidate Net Promoter Score: Your Hiring Reputation in One Number

How do candidates talk about your company after an interview? Candidate Net Promoter Score (cNPS) puts a number on that question. It asks applicants one thing: “How likely are you to recommend our recruitment process to others?”

Why it matters:

Acts as a reputation check for your hiring process

Predicts the strength of future pipelines, since promoters bring referrals and detractors discourage applicants

Connects directly to offer acceptance and early retention, as candidates who feel respected are more likely to join and stay

Research from Talent Board shows that candidates who rate their experience highly are 38% more likely to accept an offer. In other words, cNPS isn’t just a feel-good measure, it has a direct impact on hiring outcomes.

How to improve cNPS:

Keep candidates informed with timely, transparent communication

Provide constructive feedback, even to those not selected

Respect candidate time with structured interviews and efficient scheduling

Train interviewers to deliver a consistent and professional experience

At InterWiz, we see cNPS as a metric that often reveals the “silent killers” of hiring: delays, inconsistent interviews, and poor communication. By automating scheduling, structuring interviews, and streamlining feedback, InterWiz helps recruiters create an experience candidates talk positively about, even when they don’t get the job.

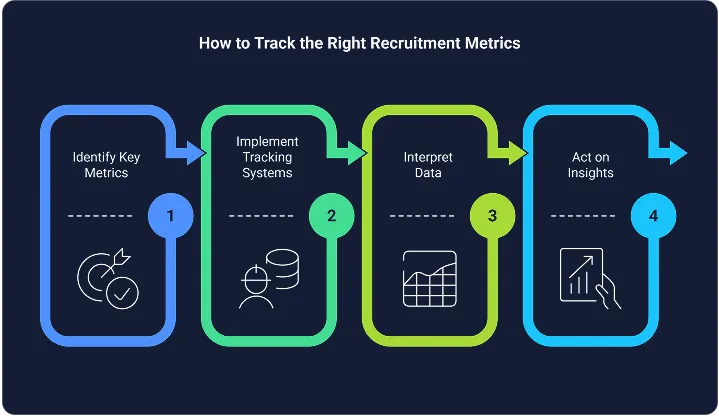

How to Track the Right Recruitment Metrics

The biggest mistake HR leaders make with metrics is volume. They track everything the ATS spits out, but nothing that proves business impact. The result is dashboards full of noise. The fix isn’t to collect more numbers, it’s to track fewer, better ones and tie them directly to business goals.

Step 1: Align key metrics with business goals

Hiring quality: Use Quality of Hire, First-Year Attrition, and Time to Productivity to ensure hires perform and stay.

Process efficiency: Track Time-to-Fill, Time-to-Hire, and funnel conversion rates to cut bottlenecks.

Budget optimization: Focus on Cost-per-Hire and sourcing channel ROI to spend smarter.

Employer brand strength: Use Offer Acceptance Rate, Candidate Net Promoter Score, and Source of Hire effectiveness to gauge brand impact.

Diversity and inclusion: Measure pipeline diversity and interview conversion rates by demographics to ensure fairness.

InterWiz strengthens quality metrics (Quality of Hire, First-Year Attrition) because structured interviews and standardized scoring make those signals more reliable.

Step 2: Implement reliable tracking systems

Use a modern Applicant Tracking System (ATS) to automatically log data across stages, sources, and timelines.

Integrate HR tools (onboarding, payroll, performance management) for a full view of the talent journey.

Add surveys for qualitative metrics like candidate and hiring manager satisfaction.

Step 3: Interpret and act on your data

Build a dashboard to visualize key trends and benchmarks in one place.

Review metrics regularly (quarterly or monthly) to spot patterns early.

Avoid tunnel vision; no single metric tells the whole story. Pair efficiency with quality and retention.

Benchmark against industry standards to set realistic goals and give leadership context.

When HR leaders align the right metrics with business strategy and act on them consistently, recruiting shifts from being an operational function to a data-driven driver of growth.

Bottom Line: Turning Recruiting Metrics Into Business Impact

Recruitment metrics aren’t about filling dashboards with numbers. They’re about answering the questions leaders actually care about: Are we hiring the right people? Are we doing it efficiently? And are we building teams that last?

The mistake many HR teams make is tracking metrics in isolation, speed without quality, cost without retention, or experience without business outcomes. Numbers only matter when they’re connected, interpreted, and acted on. When you track the right blend of efficiency, quality, experience, and diversity metrics, recruiting shifts from being a process that fills roles to a function that drives business growth.

At InterWiz, we believe this is where the future of recruiting is headed. AI structured interviews, standardized scoring, and data-driven insights don’t just make hiring faster; they make it clearer, fairer, and more defensible in the boardroom. Metrics should be more than activity reports. There should be proof that talent decisions are creating a measurable impact.

High Quality Screening with AI Interviews

Automated interviews built for speed, scale, and accuracy.

🔥 Full features, no credit card required.